The era of the envelope is approaching extinction.

Technology is clawing into nearly every facet of our lives, and paper documents are being replaced by a left click of a mouse or a touch on a Smartphone display. Nothing is safe from the switch—including the student financial aid process.

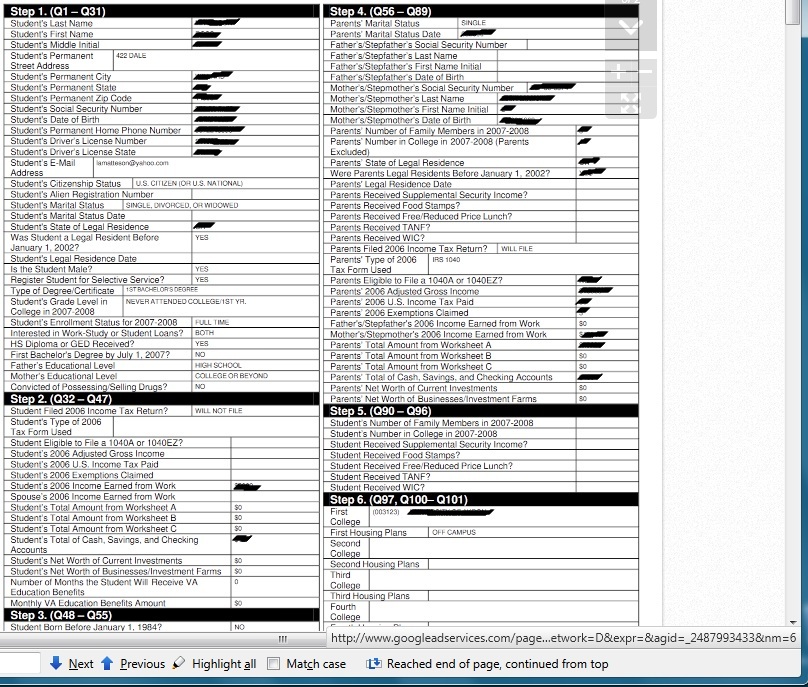

The U.S. Department of Education announced changes to the Free Application for Federal Student Aid (FAFSA) that will allow applicants to extract important financial data from the IRS database in an attempt to streamline the process. The FAFSA-IRS Data Retrieval process will allow students applying for federal aid online to quickly obtain accurate tax information from the prior year and transfer it automatically to the FAFSA, rather than combing through hard-to-find numbers in their parents’ tax returns.

According to the U.S. Department of Education website, the process was designed to make tax verification easier for students and their parents. The process will also enhance accuracy.

The site states the IRS expects more than 60 percent of applicants to use the data retrieval tool.

Applicants who choose not to use the tool must obtain a hard copy of their IRS transcript by calling or e-mailing the IRS. Photocopies will no longer be valid documentation of these tax records. Receiving the records can take anywhere from five to 10 business days.

In an e-mail sent by William J. Taggart, the Chief Operating Officer of Federal Student Aid U.S. Department of Education, on Feb. 23, 2011, Taggart wrote, “Since most applicants can quickly and easily access IRS data through the FAFSA-IRS Data Retrieval process, we no longer consider it reasonable for an institution to accept anything less reliable than direct IRS-supplied evidence for verification of income data.”

This forces financial aid offices around the country to enforce stricter tax documentation regulation.

After becoming the youngest director of financial aid at Dutchess Community College, Dan Sistarenik took the position of financial aid director at SUNY New Paltz. In the 26 years since, he has been around for many changes to the FAFSA process, including the move to make the application free. He has testified in Washington about what works and what does not.

“It’s like going through the drive-thru,” Sistarenik said, in regards to how the IRS Data Retrieval tool will make the application process easier for students.

The process will eliminate the verification of hundreds of applications thanks to information regurgitated from the IRS to the FAFSA. However, any misrepresented information, such as income or tax write-offs, will now need to be hand-checked by his office, unlike the prior policy of only checking errors off by 25 percent or more.

This could make things harder for an office that has had no growth in the last 15 years, and which recently laid-off a secretary after 32 years of service due to budget restraints.

While the federal government is trying to improve quality control by utilizing the IRS to influence who to divvy out loans to, Sistarenik believes that fraud won’t be eliminated entirely.

“There are still going to be people that beat the system,” said Sistarenik, “but with tax laws.”

Sistarenik is asking students to file their taxes two weeks before beginning the FAFSA.

He said that as of Feb. 8, only 50 percent of applicants chose to use data retrieval when filing

their FAFSA.

“I think initially it will be a culture change,” he said.

Order matters; but for students vying for work-study positions. Filing your tax information with

the IRS Data Retrieval process, or not, may mean the difference in landing a desired job.

Students filing paper tax-returns could see long delays before receiving any detailed financial aid award package from their choice universities.

“For every procedure, we have a checklist,” said Sistarenik. “When the FAFSAs come in at the end of the month, we send [students] a preliminary estimate [of cost]. So if you are one of the dinosaurs that do a paper FAFSA and paper taxes you’ll have to wait 8 weeks [to get an estimate].”

Sistarenik is expecting his office to receive an influx of phone calls due to the changes in the FAFSA process. To contend with the problem, he is proposing the creation of a new intern position in his office to deal with web navigation and FAFSA verification problems.

Not all applicants are eligible for the IRS Data Retrieval process. Applicants that are filing joint

tax returns and are divorced or separated, widowed, married and filed separate tax returns from their spouse, are the parents of a dependent student who filed their own taxes, or are filing taxes out of Puerto Rico are unable to receive a transcript from the IRS.

This will create instances where applicants from divorced households encounter filing issues, including obtaining tax information from step-parents that marry into a family.

Susan Weatherly is the former director of student admissions at SUNY Ulster. During her tenure at the college, she dealt directly with the financial aid office and encouraged accepted students to apply for financial aid as soon as possible.

Weatherly said that while dealing with applicants, she made sure to inform students about financial aid and the steps that go along with filing for it.

“Personally, I think that the FAFSA using the IRS data is terrific,” said Weatherly. “I think that it eases the question ‘where or how do I get this figure for this question on the FAFSA?’.”

Weatherly said she is happy with the opportunities technology gives students today. She likes how search engines like Google can assist students in the pursuance of grant money and scholarships.

“Some people still prefer paper,” said Weatherly, “but I think as we all become used to technology it will feel easier.”