By Briana Dunlay

It is 6:50 a.m. on a Wednesday and Kelsey Simmons is about to start her day. Her shift ended late, and she did not get home until after 10:00 p.m. A night of homework has her struggling to wake up. Simmons does not have to be at her internship until 9:00 a.m., but she totaled her car and cannot afford to fix it. Now she has to take the bus from New Paltz to Kingston, adding an extra hour to what would be a 20-minute commute. After pressing snooze on her alarm twice, she wakes up and gets ready. She puts on some mascara and lightly powders her face as she decides what to wear. A black blazer with matching slacks and a flowy white blouse is her outfit of choice.

She slowly makes her way to the kitchen and heads to her cupboard. She pulls out the peanut butter and jelly. As she waits for the bread to toast, she eats a bowl of cereal. She leaves her house groggy and half asleep and begins making her way to the New Paltz’s bus station. As she walks along, she passes her car. Its front right corner is smashed in, metal covers the tire, and a hole stands where a headlight used to. She looks at her car, and quickly looks away, but it stares back, taunting her from the driveway.

Kelsey Simmons, 21, is a sociology major with a concentration in human services and a minor in deaf studies and psychology. She is the co-founder and president of the SUNY New Paltz’s branch of Hippies for Hope, a non-profit dedicated to working to better education abroad and spreading hope in children’s hospitals.

From a far Simmons looks like any other college student. Her extensive wardrobe ranges from Forever 21 to Urban Outfitters. She has expensive technology including Apple products and a DSLR camera. This coming January she will be going on her second study abroad trip to Jamaica.

Simmons blends in because a year ago she could afford all of these things. Now, she is struggling financially.

Her grandparents once supported her and her family. When they died, Simmons had to take out a hefty amount of student loans in order to survive. The Federal Reserve Bank of New York’s research shows that 71 percent of students in 2016 graduate from a four-year college with student loan debt. The current balance of federal student loans nationwide is $902 billion, with an additional $140 billion in private student loans. One Wisconsin Institute’s research shows that while it should only take ten years to pay off a bachelor’s degree, it takes the average person closer to twenty years to pay the entirety of their student debt.

Simmons comes from a lower middle class family. Her entire life her parents struggled with money, but it was never a concern for Simmons.

“As a kid we struggled, but you would have never known,” says Simmons. “My parents made sure we had everything. They would buy us whatever we wanted, and they always made sure we blended in with the other kids. Even if that meant they went to bed hungry, they would make those sacrifices to make sure that we lived a normal life.”

Simmons’ parents were able to support her with the help of her grandparents. They lived in their house, gave them money to survive, and opened a credit card under their names.

“My mom is a nurse and she dedicated years of her life taking care of her parents,” she says. “It was a full time gig, so she couldn’t work for a long time. My grandpa died March of my freshman year of college and my grandma died eight months later. Before they died they would take care of any needs we had, and after they died, everything changed.”

Losing both of her parents was very difficult for Simmons’ mom. Being out of the job market for so many years, she struggled to find work. Simmons’ dad was getting older and was no longer able to do the taxing manual labor that once paid the bills. Simmon’s grandparents provided her parents with money to support Simmon’s and her sister. When they passed away, her parent’s’ financial stability went with them. They had to sell the grandparent’s house and they had nowhere to go. They both were struggling and became what Simmons describes as “extremely depressed.”

“My parents were lost, they were scared, and they didn’t know what to do.” – Kelsey Simmons

At the end of Simmons’ sophomore year, her dad went to see his father in his home. He visited his father four days a week, but this trip was different. His father was not sitting in his usual recliner chair in the living room. After hours of searching around town, her dad came across a pond deep in the woods behind his father’s house. He found his father’s body floating in the pond.

This discovery of his father’s death would begin her parent’s downward spiral. Shortly after, her parents began getting heavily involved in drugs and alcohol. Soon any money they had went to their addiction.

While Simmons was aware of her parent’s emotional state, she did not realize how bad they had gotten until January 2016, when her mother tried to commit suicide. Kelsey knew she could no longer rely on her parents.

“The first couple of months were the most difficult,” says Simmons.

Simmons turned to her advisor, a social worker, with who she was very close.

“She basically took the position of my mom until I got the hang of what I was doing,” says Simmons. “She sent me to a social worker who deals with cases like mine, and without both of them I would have been stranded.”

Simmons is currently $36,000 in debt, but she tries not to dwell on this number.

“I would not be able to survive without my student loans,” she says. “They pay for my apartment, they pay for my education, and they give me the money that allows me to survive.”

Because of her recent financial struggles, Simmons’ plans have changed. Her dream of moving to California and volunteering with inner city schools has been pushed aside. She cannot afford to begin paying off her student loans, and instead has to go directly to graduate school for a dual degree in social work and public health.

Simmons’ degree is only offered at expensive private schools so she anticipates her debt will rise to more than 100,000 dollars. Getting a dual degree is very important to her, so she is willing to take on the debt.

However, Simmons knows what it is like to live without the money she gets from student loans. She says living completely broke is much scarier to her than the debt she is accumulating.

“Last semester my refund check was sent to my parent’s house, and they spent it all,” says Simmons. “It was all the money I had and it was gone before I knew it arrived. I had absolutely nothing, and I couldn’t even get help.”

Simmons applied for food stamps in the spring of 2016 and got denied. She was told she was not eligible because she had to be working a minimum of 20 hours a week on top of being a full time student.

“It was so heartbreaking,” says Simmons. “I was at my lowest and I had no idea what to do. If it wasn’t for the support of my friends, boyfriend, sister, and professors, I probably wouldn’t be here.”

Simmons had to apply to be registered as financially independent from her parents. It was an extremely long, difficult process. It required many phone calls, interviews, and personal statements from a variety of people including her advisor and social worker. In most cases, a person must be at least 24, married, have children, or a veteran to be declared independent, and Simmons does not match any of these criteria.

Simmons’ financial aid has not been enough and she has been struggling because of it. All of her financial aid goes directly to rent. Still, it is not enough to completely cover it, making her behind every month. Simmons works two jobs, as a waitress at Shea O’Brien’s and a caterer for Main Course. She is still only sliding by. She started the semester out working 25 to 27 hours a week, but has cut back to 16-20 hours, because of the affect it was having on her.

“I would not be able to survive without my student loans. They pay for my apartment, they pay for my education, and they give me the money that allows me to survive.” – Kelsey Simmons

This semester Simmons is overworked and always tired. She has a cold that has lingered for weeks making her body weaker than it already is. Simmons does not have time to cook most days, and relies on the food at the restaurant. This is not always the healthiest option and it has taken a toll on her physique. Her poor eating habits, and lack of exercise have caused her to lose most of the muscle in her body. She is currently in the worse shape of her life, which only makes her tiredness worse.

Simmons says the only reason her schedule has not dramatically affected her grades is because of her understanding professors. They allow her to hand in assignments late without penalizing her and give extra credit opportunities when applicable. Their understanding nature has allowed Simmons to stay on track to graduate in May 2017 and begin graduate school that fall.

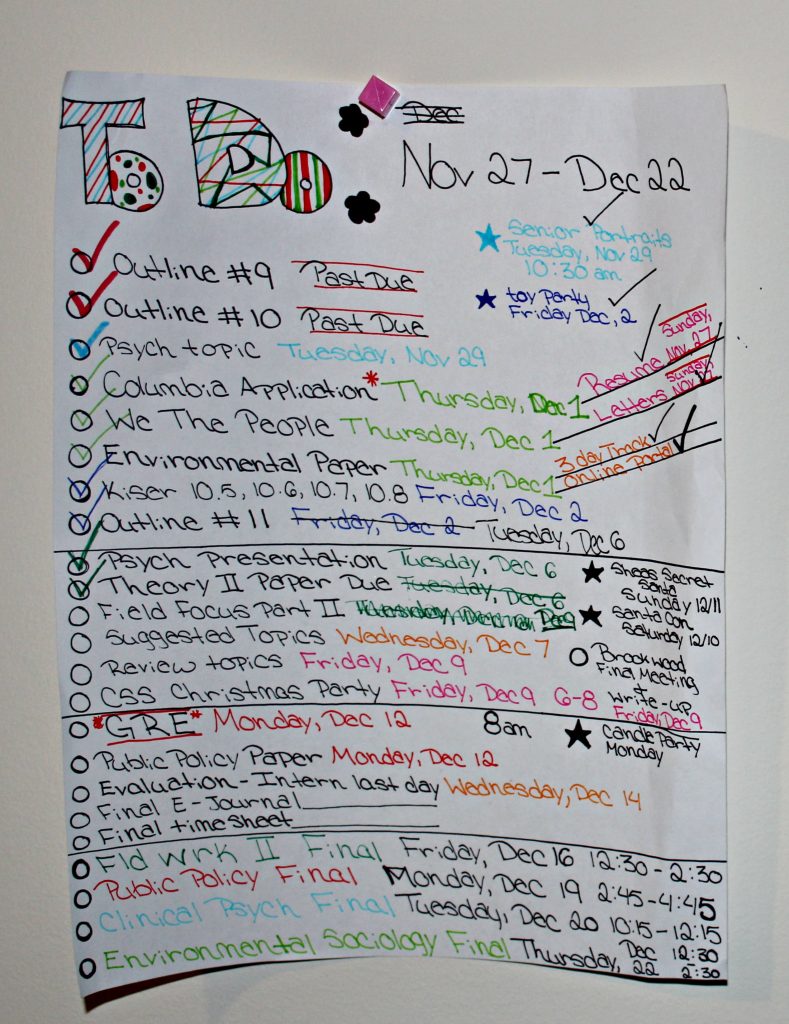

Still, she is always nervous about her grades. Her weekends used to be dedicated to homework, and now her time is spent primarily at work. During her shifts, when she is not waiting tables, or making drinks, Simmons takes out her books and studies. Simmons had to pay 50 dollars to change the date of her Graduate Record Examination (GRE) because she was not as prepared as she would have liked.

Simmons’ situation has given her skills and tools that she can use to relate to future clients, and a greater patience, understanding, and an empathy for people. However, her situation has limited her to fields she is able to worked in.

Simmons’ dad struggled with alcohol her entire life so she always imagined herself working with substance abuse patients. But since her parent’s financial situation was heavily affected by drugs, she thinks it would be too hard to work in such a field. This past year was the most difficult time in Simmons’ life, and she said she cannot work closely in a field that will remind her of the traumatic experience she had.

If she were to work in fields such as elderly and domestic violence, it would have to be internationally. This way she would be dealing with the overarching problems instead of personal clients that could bring back the haunting memories.

Her main goal is to work and create polices for students struggling like she did, and for adults who feel lost in the system, much like her parents.

Despite everything that has happened to Simmons in the past year, she remains optimistic.

“This entire situation has made me much more appreciative,” says Simmons. “Yes, it sucked, but it could have been worse. I was really mad for a really long time, but now I understand. My parents were lost, they were scared, and they didn’t know what to do.”

Simmons says the worse part about this situation was losing contact with her parents.

“I lost them as my best friends,” she says. “I have gotten the hang of living and surviving on my own, but I will never get the hang of not having someone to call when something good or bad happens in my life. The emptiness I feel without them has been the hardest to deal with. They have no idea what I am doing, what my plans are, and where I am going. It is better that they don’t have a strong influence in my life because every time they try to come back, it is just empty promises.”